Forex Day Trading Strategies

Are Forex day trading strategies right for you? If you are currently holding down a full time job, and don’t fancy the prospect of holding trades during sleep or work hours, then you should seriously consider being a Forex day trader.

While it may sound glamorous and conjure up images of traders in power suits shouting out “Buy, buy, buy!” in their trading rooms, basically all it means is that you close out all your positions at the end of your “trading day”. For most of you, a typical trading session would probably last two to three hours at the most at the end of a long day. Here are the Forex day trading strategies and tips you need to make your trading goals a reality.

Selecting The Right Timeframe For Day Trading

Without a question, if you are going to be a Forex day trader, then you will need to select the right timeframe that will give you sufficient trading opportunities that you can exit in time to close out all your positions for the day. In my mind, that timeframe is the 5 minute timeframe, although you could easily use a 10 minute timeframe and see similar returns. Any timeframe higher than that will not give you enough price action within the session to observe, analyze, enter and exit by the “end of day”. Trading a 5 minute timeframe for a 2 hour trading session will give you 24 bars, which is easily enough to make a couple of trades before you call it a day.

Video of Day Trading Strategy with Candle Stick Charts:

The Best Forex Day Trading Strategies And Tips

Some trading strategies lend themselves to the practice of day trading better than others. For example, trend following is not particularly suited for day traders because it requires you to wait for a long time for trends to form and reach their natural conclusion. The last thing you want to do is to close off a trend trade at the end of the day, only to find that it’s risen by a hundred or two hundred pips when you check on it the next day. You’re far better off with scalping strategies instead, because these are generally focused on getting you in and out quickly for maximum profits and minimum risk. If you’re starting out as a day trader, I would highly recommend scalping as the best place to begin.

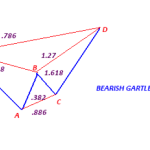

The fundamental idea behind scalping Forex is to grab the meat of the move without worrying about picking the top or bottom. Ideally, you would want to get in on one bar, ride it into profit for five to ten minutes and then get out. Of course, you can’t just be getting in and out repeatedly without a plan because you’ll just destroy your account. You will want to see that there’s a strong trend in place one way or the other, and get in while the trend is still accelerating. Personally, I use the ADX indicator to tell me when the prices are trending strongly, and the MACD indicator to tell me when the trend is accelerating. You can easily see from the MACD histogram whether the momentum of the trend is picking up or slowing down, just check the slope.

The Final Word On Forex Day Trading Strategies

The most important thing about executing Forex day trading strategies successfully is to adopt a quickly in and quickly out attitude. You’re not worried about squeezing every drop of profit from each trade, you simply want to capture the “easiest” part of each move. If there are no attractive moves on the horizon, don’t be afraid to simply switch off your computer and have some family time or catch up with friends. That’s the beauty of day trading Forex – there’s always tomorrow!

Related Posts

Have you Tried Binary Options Trading Yet?

Binary Options trading is one of the newest forms of trading to hit the markets. Binary options allows you to trade currencies, stocks or indices with fixed odds. For more information visit our recommended broker now:

Binary Options trading is one of the newest forms of trading to hit the markets. Binary options allows you to trade currencies, stocks or indices with fixed odds. For more information visit our recommended broker now: